|

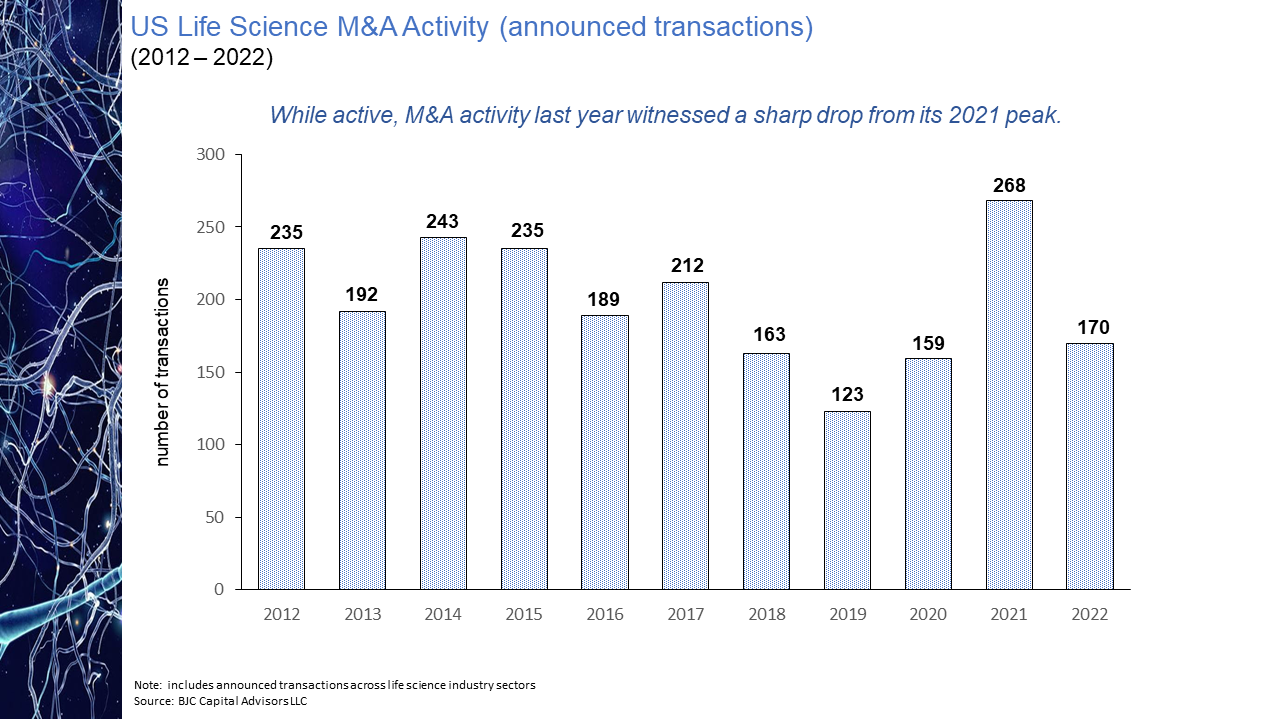

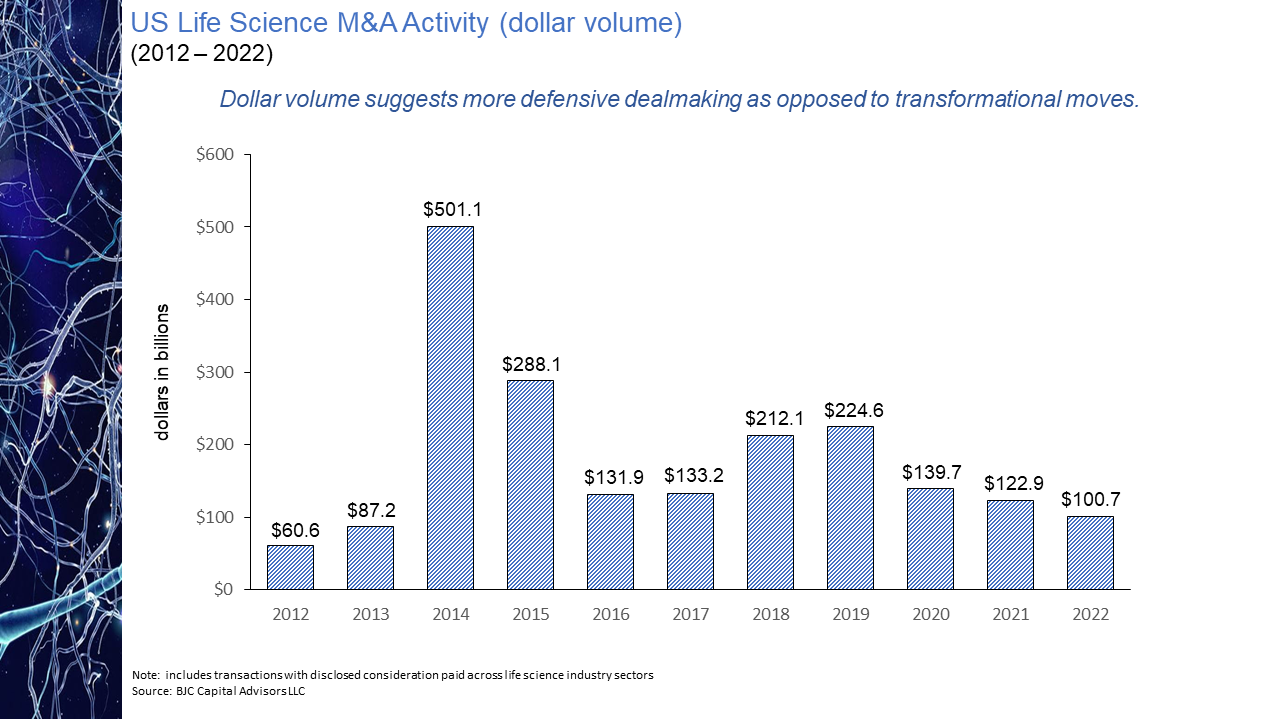

The IPO torrent of 2020 and 2021, during which time some 170 new issues came to market came to a screeching halt in 2022. Only 11 IPOs of any real size priced in 2022, four of them in the first two months of the year and prior to Russia’s invasion of Ukraine. That dearth in IPO activity has continued into 2023 with only two meaningful new issues, Structure Therapeutics and Mineralys Therapeutics, coming to market. Even if the economic uncertainties that have clouded the market picture were to somehow resolve themselves, it seems unlikely that investors will regain enthusiasm for the sector any time soon with the XBI down more than 50% from its February 2021 high water mark. With biopharma currently out of public market favor and with valuations substantially discounted relative to their 2021 levels, many industry participants believe the pace of mergers and acquisition activity is bound to accelerate, as strategic acquirors step in to bolster pipelines with promising clinical candidates at depressed prices. Evidence does not seem to support this position. As seen in the chart below, measured by number of announced life science transactions, while M&A activity did not follow IPOs off a cliff last year, the level of activity did pull back quite considerably, down nearly 37% year-over-year. This decline in dealmaking suggests that despite what may be considered a buyer’s market, the appetite of large pharmaceutical companies to expand their cash burn rates is limited especially for assets whose payback is often many years off, if then. Not surprisingly and not unlike other industry sectors, M&A interest in times of economic uncertainty in the pharma industry appears to be more narrowly focused on smaller, complementary “bolt-on” acquisitions rather than bold, transformational moves. This deal bias is perhaps best reflected in the aggregate dollar volume of transactions announced in 2022, the $101 billion total the lowest in a decade while the number of announced transactions displayed a slight uptick over the years immediately pre-pandemic. The 35% decline from 2021 in the number of billion-dollar deals is further indication of this more conservative M&A mindset. Hence while industry lore may have us believe interest in strategic M&A increased with public market downturns, actual transaction data is evidence of quite the opposite.

Comments are closed.

|

About the AuthorBen Conway is a long-tenured investment banker with a primary focus on the biopharmaceutical sector. In addition to investment banking, his experience includes positions in large pharma as well as with smaller emerging biotech platforms. Archives

February 2024

|

BJC Capital Advisors LLC

Boston, Massachusetts

(617) 834-8482

Boston, Massachusetts

(617) 834-8482

RSS Feed

RSS Feed