IPO Advisory Services

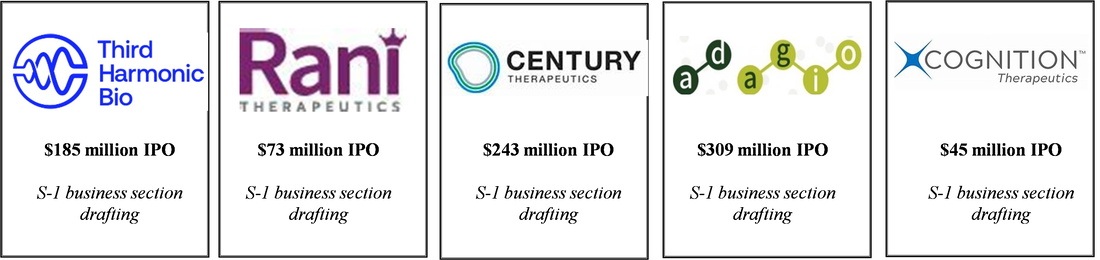

The drafting of the business section of an SEC Form S-1 or F-1 registration statement is a critical step in initiating the IPO process and its thoughtful preparation of vital importance in building public market interest and enthusiasm. A well-crafted document ahead of the organizational meeting can also significantly shorten what is often the most time-consuming portion of the registration effort. Its completion requires the integration of disparate talents, including an intimate appreciation of life sciences, capital markets savvy and perspective on SEC scrutiny. We have drafted numerous completed IPOs for companies targeting a range of disease indications employing diverse technologies with many more filed on behalf of our clients. We are highly experienced in this process and have a team of specialists eager to assist. Representative S-1 business section drafts prepared by principles of the firm include:

The drafting of the business section of an SEC Form S-1 or F-1 registration statement is a critical step in initiating the IPO process and its thoughtful preparation of vital importance in building public market interest and enthusiasm. A well-crafted document ahead of the organizational meeting can also significantly shorten what is often the most time-consuming portion of the registration effort. Its completion requires the integration of disparate talents, including an intimate appreciation of life sciences, capital markets savvy and perspective on SEC scrutiny. We have drafted numerous completed IPOs for companies targeting a range of disease indications employing diverse technologies with many more filed on behalf of our clients. We are highly experienced in this process and have a team of specialists eager to assist. Representative S-1 business section drafts prepared by principles of the firm include: