|

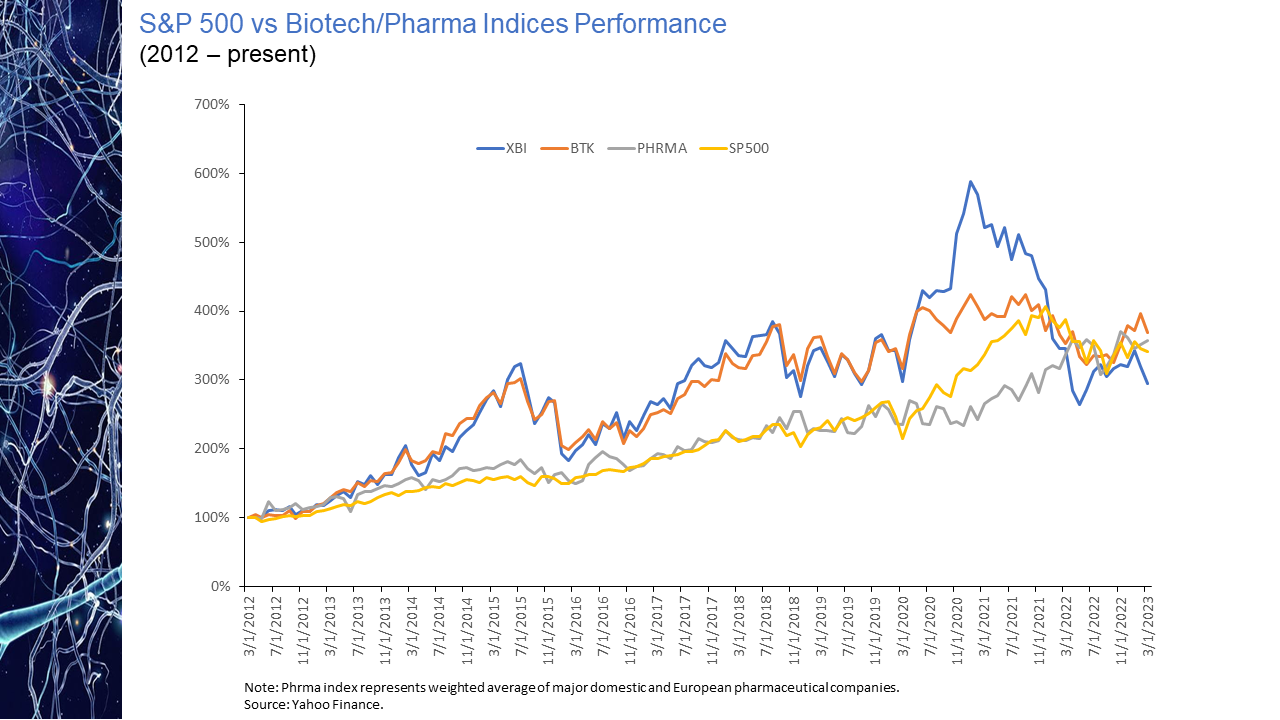

The ongoing shift over the last decade towards biopharma as the primary originator of industry innovation, and the disproportionate value it generated, is perhaps best reflected in the market performance of the biopharma sector when compared to that of traditional pharmaceutical companies. As is noted in the chart presented below, over the last decade, the cumulative advance of biopharma, in particular the increase in the XBI index of earlier-stage biopharma companies, far outpaced the gains achieved by the traditional pharmaceutical industry. Remarkably, the spread in cumulative market appreciation between the XBI and traditional pharma approached an astounding 300% at its peak in early 2021. That contrast in market appreciation, achieved over a nearly ten-year period, quickly vanished in the year that followed. The perception of R&D as a key valuation driver during a time of relatively inexpensive money, appears to have quickly reversed itself, with the cumulative gains of a decade evaporating virtually overnight. Perhaps in anticipation of the higher interest rate environment that we now find ourselves in, sentiment began to shift even before the first interest rate hike. This valuation reset has reduced the aggregate returns of the XBI to below those of traditional pharma for the first time in ten+ years. While the implications of that reset are likely to reverberate until further economic clarity is achieved, interest rate stability may usher in renewed sector advance.

Comments are closed.

|

About the AuthorBen Conway is a long-tenured investment banker with a primary focus on the biopharmaceutical sector. In addition to investment banking, his experience includes positions in large pharma as well as with smaller emerging biotech platforms. Archives

February 2024

|

BJC Capital Advisors LLC

Boston, Massachusetts

(617) 834-8482

Boston, Massachusetts

(617) 834-8482

RSS Feed

RSS Feed